Gurgaon-based mobile wallet service firm MobiKwik plans to raise up to $255 million in an initial public offering, becoming the latest Indian startup to explore the public markets.

The 12-year-old firm, which counts Sequoia Capital India and Abu Dhabi Investment Authority among its investors and has raised about $250 million to date, plans to offer new shares of up to $201 million and sell up to $54 million worth of equity shares, according to papers submitted to the market regulator on Monday.

The firm, which allows users to pay digitally and also cross-sells small sachet of insurance and loans as well as provides them with American Express-powered credit cards, is targeting a valuation of about $1 billion in the IPO, according to two people familiar with the matter.

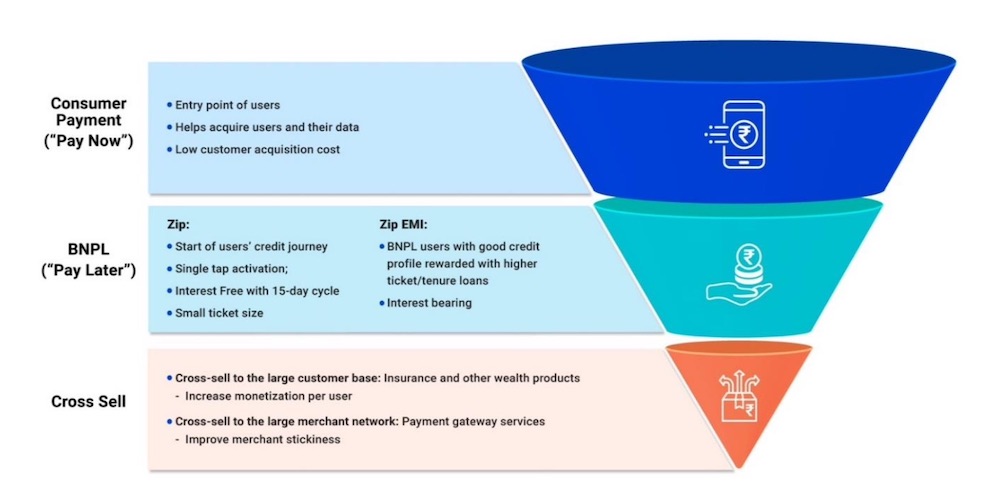

“We believe our key competitive advantages include our ability to (i) cross-sell; (ii) leverage data science and technology; and (iii) efficiently manage risk,” wrote MobiKwik in papers submitted to the market regulator on Monday. (Image: MobiKwik)

MobiKwik said its total income for the financial year that ended in March 2021 was about $40.5 million, down 18%, while its loss also shrank 12% to $14.9 million during the period.

MobiKwik’s move comes as a handful of Indian startups including Zomato and Paytm are working to list on stock exchanges. Zomato, a food delivery startup in India, last week boosted its plan to raise $1.3 billion in its initial public offering, which opens on July 14 and closes July 16.

This is a developing story. More to follow…