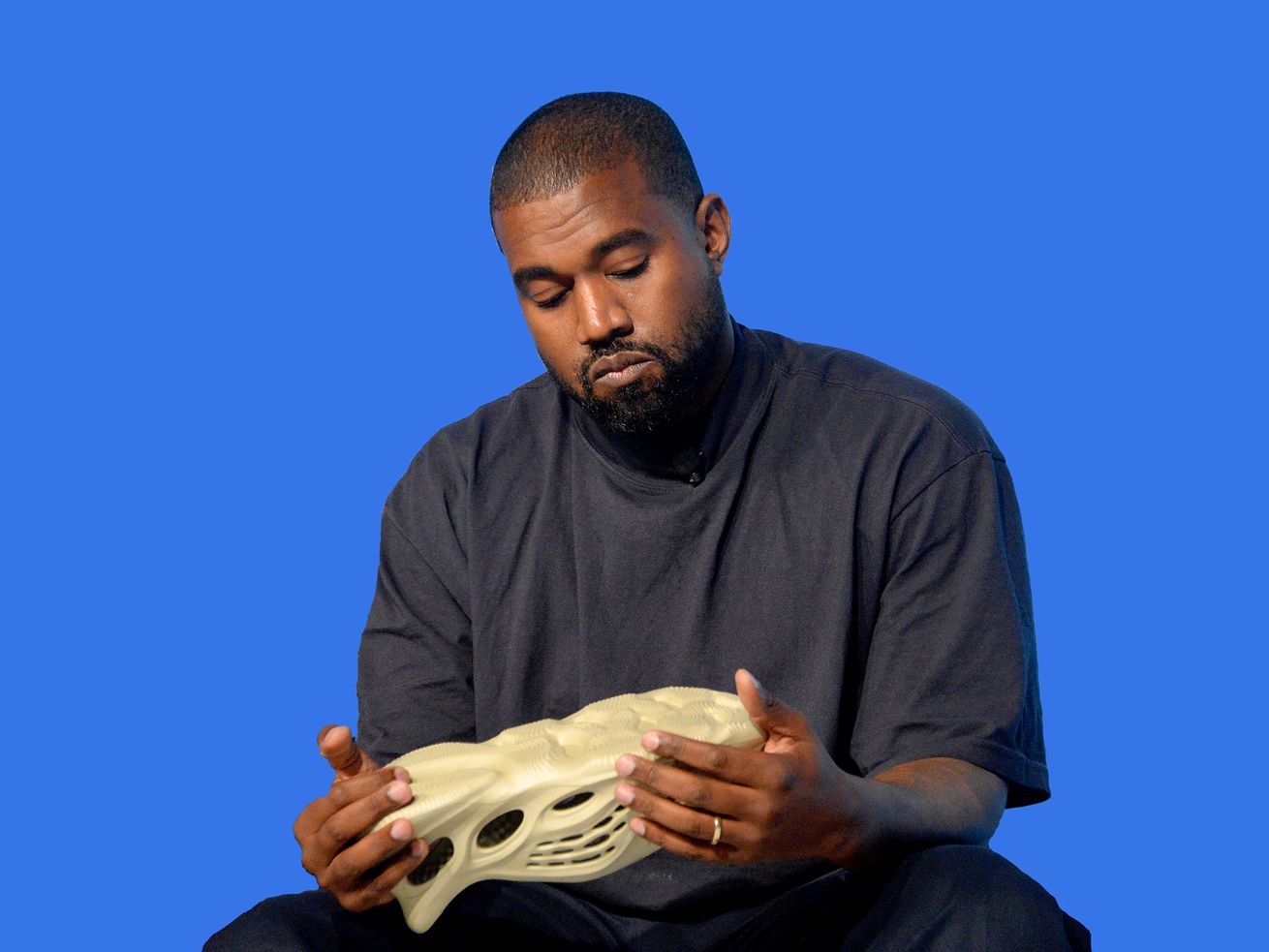

Resellers turned Yeezys into a goldmine for sneaker resale sites. What happens now?

Adidas ended its seven-year business partnership with Ye, formerly known as Kanye West, earlier this week after the artist made a series of antisemitic remarks and wore a “white lives matter” shirt at Paris Fashion Week. Now, the ripple effects of Adidas halting production of the popular Yeezy brand of footwear and apparel has cascaded outside of the company, and into a burgeoning, lucrative, and broader sector: the sneaker resale market.

This slice of the shopping world is where sneakerheads, collectors, and professional resellers alike buy and sell rare or in-demand footwear through online marketplaces like StockX, GOAT, and eBay. In recent years, it’s grown into a $4 billion-plus industry in North America alone, with the potential to reach $30 billion globally by 2030, according to Cowan research. But the problem for the big resale players in the industry is that the market is dominated by just three brands. And one of them is Yeezy.

Nike, Jordan Brand, and Yeezy currently account for more than 90 percent of sales in the resale market, according to Cowan. And with Adidas announcing this week that it was dissolving the partnership with Ye, and would no longer produce or sell Yeezy-branded goods, these online businesses that aim to fulfill every hypebeast’s desires may suddenly have to look elsewhere to diversify their businesses to keep loyal customers coming back to shop them frequently. The hype associated with new Yeezy releases isn’t what it once was, but the lack of future supply will still likely leave a huge gap.

“It’s possible there’s some short-term pop, but I think the Yeezy era could be over,” said Dylan Dittrich, the head of research at Altan Insights, which publishes information on collectible categories like sneakers, watches, and sports cards.

When Adidas announced on October 25 that it would “stop the adidas Yeezy business with immediate effect,” finally putting the kibosh on a partnership that critics said should have happened much sooner, the resale platforms that benefit from Yeezy sneaker and clothing sales had a decision to make. But their answer soon became clear. With the exception of one smaller player in the Yeezy resale space, The RealReal, the other online marketplaces would continue to let sellers list Yeezy products and buyers purchase them. Yet none of them wanted to talk about that decision. StockX, GOAT, and eBay all failed to respond to requests for interviews or comment.

The most-popular product lists on these sites perhaps explain why. On Thursday, eight of the top 12 best-sellers on StockX were Yeezys, with the site selling thousands of Yeezy Slide sandals over the last three days alone. Dittrich, the Altan Insights research head, said prices of Yeezy Boost 350 V2s, perhaps the most recognizable sneaker model in the Yeezy portfolio, rose between 10 and 30 percent on StockX after Adidas’s announcement. It looked like fans, collectors, and resellers were making a calculated bet that the lack of future Yeezy supply would increase the value of the artist’s existing footwear — no matter the controversy. Those prices have started to come down in the days since, but not below their pre-breakup position, Dittrich said.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24148633/558271.jpg) Adidas

AdidasKola Tytler, who once helped run the Yeezy-centric Yeezy Mafia news site and is the founder of a Milan-based sneaker and streetwear resale store called Dropout, told Recode that resale shop owners across Europe have been stocking up this week on popular Yeezy styles “as it is difficult to see prices and demand dropping significantly despite the controversy.” Visitors to Dropout’s e-commerce site, dropoutmilano.com, have also been searching for Yeezys this week at higher rates in the past.

All of that sounds like a good thing for the shopping sites fulling sneakerheads’ demand. Heightened interest and higher prices typically result in a larger cut of sales for these companies. But what happens if, or when, fewer customers want to don fashion associated with Ye? Or simply when the impact of Adidas not making any new Yeezy merch is felt and the supply runs low?

In its breakup announcement, Adidas said that it is “the sole owner of all design rights to existing products as well as previous and new colorways under the partnership.” Stock analysts said the company is planning to produce Yeezy designs under the Adidas brand name. It seems unlikely that those products can carry resale value and hype commensurate to Yeezy without Ye’s name or involvement being attached to the product.

“I struggle to see adidas coming close to replicating YEEZY’s success without Kanye,” Tytler wrote to Recode.

Ye has said he will sell new sneaker designs but will need a new partner, which may be a tough assignment; he was escorted out of Skechers headquarters on Wednesday after showing up “without invitation.”

Then again, StockX and GOAT, both founded in 2015, have been making efforts to diversify away from sneakers in recent years, even before the Yeezy fiasco. StockX now has categories for trading cards, collectibles, and accessories, in addition to sneakers, shoes, and apparel. GOAT is earlier in that journey, with its parent company announcing on October 17 that it planned to acquire Grailed, a resale site more known for non-sneaker fashion. But with both privately held, venture capital-backed companies eyeing eventual IPOs, the race to replace Yeezys may be critical. In the meantime, they’ll take whatever sales and profits that come with the brand that they can still get.