News broke this morning that Bain Capital Private Equity and Crosspoint Capital Partners are purchasing Seattle-based network security startup ExtraHop.

Part of the Network Detection and Response (NDR) market, ExtraHop’s security solutions are for companies that manage assets in the cloud and on-site, “something that could be useful as more companies find themselves in that in-between state,” report Ron Miller and Alex Wilhelm.

Just one year ago, ExtraHop was closing in on $100 million in ARR and was considering an IPO, so Ron and Alex spoke to ExtraHop CTO and co-founder Jesse Rothstein to learn more about how (and why) the deal came together.

Have a great week, and thanks for reading!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Xometry is taking its excess manufacturing capacity business public

Image Credits: Prasit photo (opens in a new window)/ Getty Images

Xometry, a Maryland-based service that connects companies with manufacturers with excess production capacity around the world, filed an S-1 form with the U.S. Securities and Exchange Commission last week announcing its intent to become a public company.

As the global supply chain tightened during the pandemic in 2020, a company that helped find excess manufacturing capacity was likely in high demand.

But growth aside, it’s clear that Xometry is no modern software business, at least from a revenue-quality profile.

It’s time for security teams to embrace security data lakes

Image Credits: Malorny (opens in a new window) / Getty Images

The average corporate security organization spends $18 million annually but is largely ineffective at preventing breaches, IP theft and data loss. Why?

The fragmented approach we’re currently using in the security operations center (SOC) does not work. It’s time to replace the security information and event management (SIEM) approach with security data lakes.

The reduced reliance on the SIEM is well underway, along with many other changes. The SIEM is not going away overnight, but its role is changing rapidly, and it has a new partner in the SOC — the security data lake.

China’s drive to compete against Starlink for the future of orbital internet

Image Credits: STR/China News Service (CNS)/AFP (opens in a new window)/ Getty Images

There has been a wave of businesses over the past several years hoping to offer broadband internet delivered from thousands of satellites in low-Earth orbit (LEO), providing coverage of most of the earth’s surface.

In tandem with the accelerated deployment of SpaceX’s Starlink constellation in 2020, China has rapidly responded in terms of policy, financing and technology. While still in early development, a “Chinese answer to Starlink,” SatNet, and the associated GuoWang are likely to compete in certain markets with Starlink and others while also fulfilling a strategic purpose from a government perspective.

With considerable backing from very high-level actors, we are likely to see the rollout of a Red Star(link) over China (and the rest of the world) over the coming years.

This SPAC is betting that a British healthcare company can shake up the US market

Image Credits: Nigel Sussman (opens in a new window)

Babylon Health, a British health tech company, is pursuing a U.S. listing via a blank-check company, or SPAC.

While we wait for Robinhood’s IPO, The Exchange dove into its fundraising history, its product, its numbers and, bracing ourselves for impact, its projections.

The hidden benefits of adding a CTO to your board

Image Credits: Westend61 / Getty Images

Conventional wisdom says your board should include a few CEOs who can offer informed advice from an entrepreneur’s perspective, but adding a technical leader to the mix creates real upside, according to Abby Kearns, chief technology officer at Puppet.

Beyond their engineering experience, CTOs can help founders set realistic timelines, help identify pain points and bring what Kearns calls “pragmatic empathy” to high-pressure situations.

They can also be an effective advocate for founder teams who need help explaining why a launch is delayed or new engineering hires are badly needed.

“A CTO understands the nuts and bolts,” says Kearns.

6 career options for ex-founders seeking their next adventure

Image Credits: Marie LaFauci / Getty Images

As someone with “founder” on your resume, you face a greater challenge when trying to get a traditional salaried job.

You’ve already shown that you really want to lead a company, not just rise up the ladder, which means some employers are less likely to hire you.

So what should you do? Especially if your life partner and/or bank account are burnt out on the income volatility of startups?

Here are six options for ex-founders planning their next move.

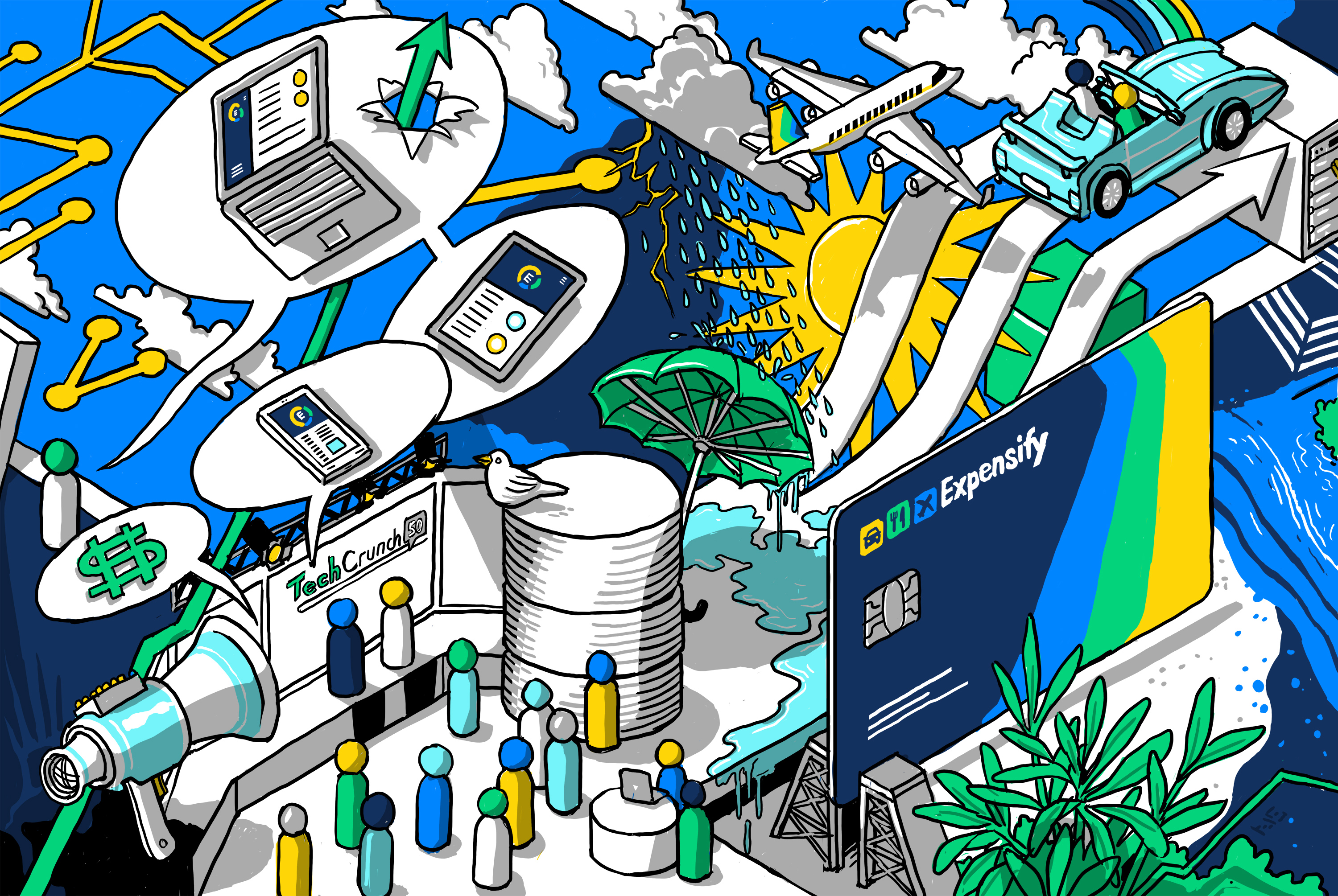

How bottom-up sales helped Expensify blaze the path for SaaS

Image Credits: Nigel Sussman

In the fifth and final part of Expensify’s EC-1, Anna Heim explores how the company built its business, true to form, in an unexpected way.

“You’d expect an expense management company to have a large sales department and advertise through all kinds of channels to maximize customer acquisition, Anna writes. But “Expensify just doesn’t do what you think it should.

“Keeping in mind this company’s propensity to just stick to its guts, it’s not much of a surprise that it got to more than $100 million in annual recurring revenue and millions of users with a staff of 130, some contractors, and an almost non-existent sales team.”

How is that much growth possible without a sales team? Word of mouth.