If, in 2017, you had taken a gamble and purchased a comparatively new digital currency called Bitcoin, today you would be a millionaire many times over. But while the industry has provided windfalls for some, local communities have paid a price.

Cryptocurrency is created by computers solving complicated mathematical equations—a process that took off after a Chinese company called Bitmain started selling a machine in 2016 with application-specific integrated circuits that made it possible to do this specialized computing much more quickly. “Almost overnight,” says Colin Read, a professor of economics and finance at the State University of New York at Plattsburgh, “a crypto-mining arms race began.”

Each Bitcoin transaction consumes 1,173 kilowatts

People began scouring the world for cheap sources of energy to run large Bitcoin-mining farms using these circuits. Cryptocurrency notoriously devours electricity; each Bitcoin transaction consumes 1,173 kilowatts—more than the average American uses in a month. In 2020, the world’s crypto mining required more energy than the whole of Switzerland. At the time, Plattsburgh had some of the least expensive power anywhere in the United States, thanks to cheap hydroelectricity from the Niagara Power Authority.

It didn’t take long for a subsidiary of the popular mining firm Coinmint to lease a Family Dollar store in Plattsburgh. The city’s building inspector, Joe McMahon, remembers that the man who signed the lease, Prieur Leary, wanted everything done quickly. “Overnight, he wanted power on,” McMahon says. “We were all uneasy about it but didn’t know the harm.”

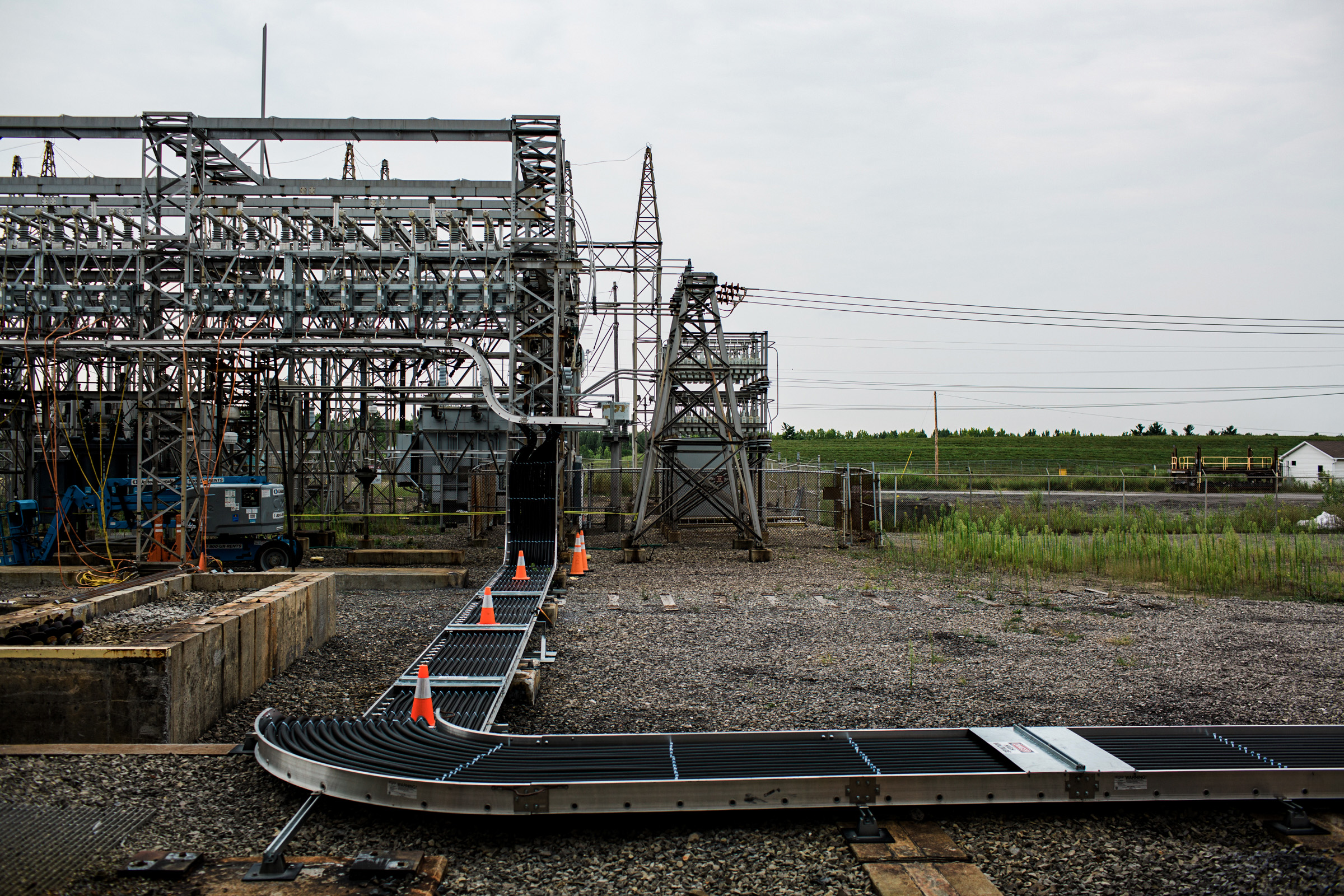

Coinmint filled the building with servers, running them 24 hours a day. When the miners wanted to expand into a nearby shopping center, Bill Treacy, the manager of the Plattsburgh municipal lighting department, told them that they would have to invest $140,000 in new infrastructure. He was surprised when they weren’t discouraged. Soon, the company was regularly drawing over 10 megawatts, enough power for about 4,000 homes.

Other miners were quick to follow. Treacy recalls one prospector calling to see if he could get five gigawatts—“I said, ‘Excuse me. That’s a quarter of what New York state uses on a given day!” Plattsburgh was soon receiving a major mining application every week.

receiving a major crypto-mining

application every week.

In January 2018, there was a cold snap. People turned up their heat and plugged in space heaters. The city quickly exceeded its quota of hydropower, forcing it to buy power elsewhere at much higher rates. McMahon says his Plattsburgh home’s energy bill jumped by $30 to $40 a month. “People felt there was a problem but didn’t know what to attribute it to,” he says.

As the long winter began to thaw, neighbors noticed a new disturbance: mining servers generate an extreme amount of heat, requiring extensive ventilation to avert shutoffs. Those fans generated a constant, high-frequency whine, McMahon says, “like a small-engine plane getting ready to take off.” It wasn’t just the decibels, but the pitch: “It registers at this weird level, like a toothache that won’t go away.” Carla Brancato lives across the river from Zafra, a crypto-mining and hosting company owned by Plattsburgh resident Ryan Brienza. She says that for several years her condo vibrated from its noise, as if someone were constantly running a vacuum upstairs.

Meanwhile, the automated nature of these servers meant that the new mines provided few local jobs. “I’m pro–economic development,” Read says, “but the biggest mine operation has fewer jobs than a new McDonald’s.” Plattsburgh doesn’t have a city income tax, and most miners lease their buildings, meaning they aren’t paying property taxes. Elizabeth Gibbs, a city councilor, was shocked when she went to tour one of the operations. “I was blown away by how hot it was—so hot and so loud,” she says. She describes a warehouse filled with hundreds of servers in stacks, connected by umbilical-like wires, with doors and windows left wide open to let cool air in.

was regularly drawing over 10

megawatts, enough power for about

4,000 homes.

Read, who became mayor in 2017, decided to impose a moratorium on new crypto mines until the city could figure out what to do. First, the New York Public Service Commission created a rider requiring high-density users to pay higher rates. It also required crypto companies to cover specialized infrastructure up front and put down a security deposit to ensure that their bills got paid. Based on two months of electricity use, Coinmint’s deposit was $1,019,503. The company spent two years pursuing appeals with the New York State Department of Public Service. “In the end, they lost,” Treacy says.

Next, Plattsburgh updated its building codes and noise ordinances. (As an established business, Coinmint voluntarily agreed to work with the city.)

Brienza, for his part, doesn’t think the moratorium was necessary. “The city could have attracted a lot of business,” he says. Zafra’s new facility, he says, has made noise reduction a priority; Brancato says after the city worked with Zafra to turn down its fans last summer, her home is finally quiet.

Now Plattsburgh is again accepting new crypto-mine applications. Yet with the new regulations in place, they’ve seen little interest. Instead, mining has surged in the nearby town of Massena, where Coinmint signed a long-term lease for a former Alcoa aluminum plant. In 2021, Massena also halted new crypto-associated businesses. “Our goal is not to prevent business, but to make sure the character and safety of our town is protected,” wrote a town board member in an emailed statement.

From 2016 to 2018, crypto mining in upstate New York increased annual electric bills by about $165 million for small businesses and $79 million for individuals, a recent paper found. “Obviously if you’re an investor, you see the value of crypto,” McMahon says, “but me, living in this community? I don’t.”

Economist Matteo Benetton, a coauthor of the paper and a professor at the Hass School of Business at the University of California, Berkeley, says that crypto mining can depress local economies. In places with fixed electricity supplies, operations suck up grid capacity, potentially leading to supply shortages, rationing, and blackouts. Even in places with ample access to power, like upstate New York, mining can crowd out other potential industries that might have employed more people. “While there are private benefits, through the electricity market, there are social costs,” Benetton says.

These impacts are now being felt across the country. Benetton says there are strong profit incentives to keep as many servers running as possible, and he is now calling for greater transparency in these companies’ energy usage. That’s not a popular opinion within the industry. But, says Benetton, “if you’re really doing good, you shouldn’t be afraid to disclose the data.”

The federal government does not currently monitor cryptocurrency’s energy consumption, but Securities and Exchange Commission chair Gary Gensler recognizes that there are gaps in regulation. In a 2021 speech at the Aspen Security Forum, he referred to the industry as “the Wild West.”

As long as mining is so profitable, Read warns, crypto bans just shift the harm to new locations. When China banned crypto mining in 2021 to achieve its carbon reduction goals, operations surged in places like Kazakhstan, where electricity comes primarily from coal. As a result, a recent study found, Bitcoin’s use of renewable energy dropped by about half between 2020 and 2021, down to 25%.

Even when the industry invests in renewable energy, its sheer consumption makes it a significant contributor of carbon emissions.

To support MIT Technology Review’s journalism, please consider becoming a subscriber.

Read dismisses the promises that green investments or greater efficiencies can solve this problem. In a recent working paper, he found that cryptocurrency’s energy usage will rise another 30% by the end of the decade—producing an additional 32.5 million metric tons of carbon dioxide a year. As long as the price of Bitcoin goes up, the rewards of mining increase, which spurs energy use, he says. He refers to this situation as “the Bitcoin Dilemma.”

Those 32 million metric tons of carbon dioxide will make the climate crisis even worse, whether the emissions are coming from upstate New York or Kazakhstan. “We all suffer as a consequence,” says Read.

Lois Parshley is an investigative science journalist.