Unacademy has raised $440 million in a new financing round as the Indian online learning startup looks to expand into multiple additional categories.

Temasek led the Bangalore-based startup’s new financing round while Mirae Asset and existing investors including SoftBank Vision Fund 2, General Atlantic, Tiger Global as well as Zomato co-founder and chief executive Deepinder Goyal and Oyo founder Ritesh Agarwal participated in it, the startup said without disclosing the name of the new round (which should be Series G).

The new round values the six-year-old startup at $3.44 billion, up from $2 billion in November last year. The investment brings Unacademy’s to-date raise to $880 million, according to insight platform Tracxn.

The online learning platform, which began its journey on YouTube and still uses Google’s video platform to on-board educators, helps students prepare for competitive exams to get into college, as well as those who are pursuing graduate-level courses.

On its app, students watch live classes from educators and later engage in sessions to review topics in more detail. The startup has over 10,000 educators on its platform, many of whom are very popular on YouTube. These educators help Unacademy sell more subscriptions and in return get a commission, according to industry executives familiar with the business arrangement.

Unacademy has amassed over 5 million monthly active users in over 10,000 cities in India.

Gaurav Munjal, Unacademy co-founder and chief executive, said the startup will deploy the fresh capital to broaden its bets on new categories such as jobs and hiring.

Relevel is “giving people a path to get their dream job irrespective of their educational background, while Graphy is “empowering creators to build their online businesses to sell digital goods including NFTs,” he said in a tweet.

In a recent conversation with TechCrunch, Munjal said he wants Unacademy to become the “Tencent of India.”

The startup competes with scores of firms including Byju’s, which is India’s most valuable startup (at $16.5 billion valuation), GGV-backed Vedantu, Tiger Global-backed Classplus, and Lightspeed Venture-backed Teachmint.

At stake is India’s online education market, which is estimated to grow to be worth about $20 billion by 2030 (up from about $1 billion last year), according to Bernstein.

As of last year, there were about 6 million students in India who were paying for an online learning app, a figure Bernstein analysts expect to reach about 70 million by the end of the decade.

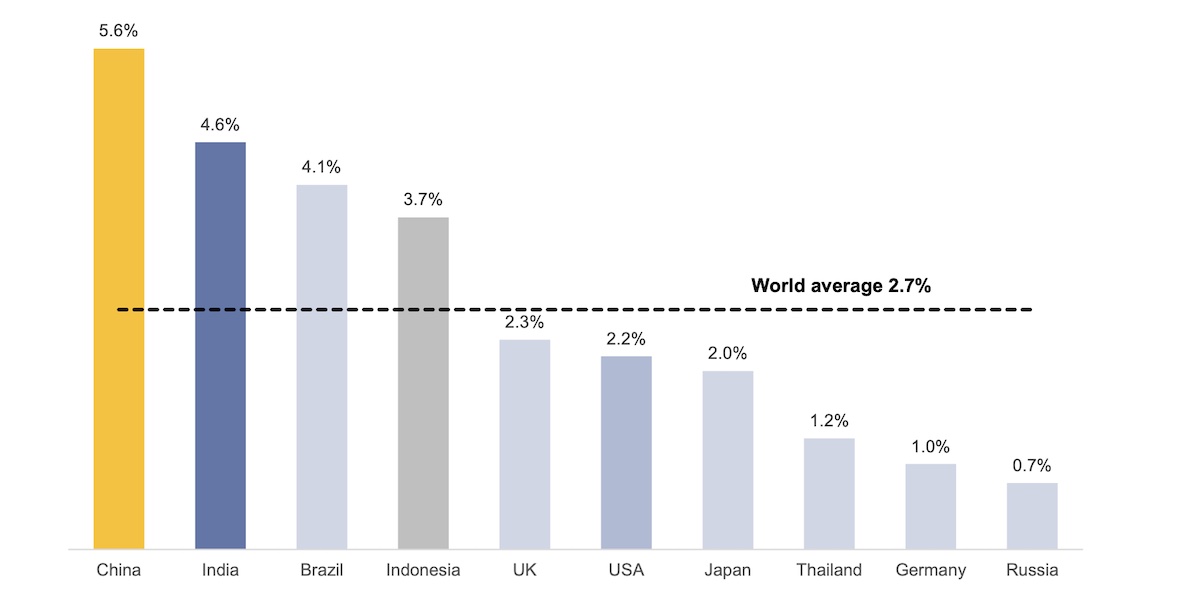

Spendings on education in India is among the highest globally (Source: A report from analysts at Goldman Sachs to clients last year.)

This is a developing story. More to follow…